In Germany, what can you expect to earn as a PhD or Postdoc?Interested in knowing the salary of a PhD or Postdoc in Germany? Did you receive an offer for TV-L E13 (75%)? Are you a Postdoc in TV-L E13 and would like to know deductions? Perhaps, a German University or Research Centre has offered you a PhD or Postdoc contract, but you’re not sure what TV-L E13 (50%), TV-L E13 (75%), or TV-L E13 (100%) mean? In this post, we describe which parameters determine the PhD and Postdoc salary in Germany.

We also make sure to explain so many terms (in German) about this subject. Therefore, this post is helpful for both new or senior PhD students and Postdocs!

Increasing PhD Stipend 2023-2024 in UK

In Germany, similar to other European countries, Universities hire PhD students, and postdocs are on a fixed-term contract. There is no cap on the length of the work contract and can be as short as three months up to three years. In exceptional cases, the employment contract of Postdocs can be five years. German Universities offer TV-L E13 to both PhD students and postdocs. However, the contract level (Stufe) and working hours (Arbeitszeite) are different which we explain in the following section. The typical work contract of PhD students is TV-L E13 (75%) while postdocs are on TV-L E13 (100%). In rare cases, the host institute can offer TV-L E14 to a postdoc.

The PhD and Postdoc salary in Germany is based on “Tarifvertrag für den Öffentlichen Dienst der Länder (TV-L)”. TVL translates to English as “the Collective Agreement for the Public Service of the states”. So as a PhD student Postdoc or even professor, your salary will be defined in various Remuneration (Entgelt (E)) of TVL which will be explained in the next section.

What is Entgelt (remuneration/payment)?

Entgelt (remuneration) is the level of payment set by the employer. It reflects the formal duties of the job and the level of competencies that the employee in that group has. For instance, Entgelt 13 to 15 (TV-L E13-15) is for employees with academic higher education. Entgelt 9 to 12 (TV-L E9-12) is for those employees with a completed technical college education. Entgelt 5 to 8 (TV-L E5-8) is for workers who have vocational training. As an alternative to a funded PhD position, you can also apply for DAAD doctoral scholarship. The following video explains the 10 reasons why you should do your PhD in Germany in 2023.

How much is the net salary of PhD students and postdocs in Germany?

It is not an easy question to answer in a few words. In this post, we try to explain the first meaning of each term of the contract and taxing system in Germany. So at the end of this post, you will be able to find out how much your net salary (take-home money) will be.

Arebitszeit (working hours/ hours of work) of PhD students and Postdocs in Germany

The most important factor which determines the take-home money is Arbeitszeit (working hours). For PhD students, this value generally is either 50%, 67%, 75%, or in exceptional cases 100%. The Germans call these terms “halben Stelle” (half-appointment), “dreiviertel Stelle” (three-quarter appointment) and “vollen Stelle” (full-appointment), respectively. This number corresponds to the percentage of the working hours of the employees in comparison to the required working hours of a full-time employee. So, PhD students with a 50% working hours contract are being paid half of the salary of a full employee in the same Engelt group. Note that despite being employed on a half-term contract, the working expectation is similar to the full-time employee’s!

The postdocs are generally on full appointment (vollen Stelle) corresponding to TV-L E13 100%. The common practice is the person with a 50% working contract will have fewer teaching assistant duties than a 100% one. That means, your supervisor (Doktorvater in German) will load you with fewer jobs such as Tutoring, Lab instructor or co-supervision of undergraduate students than other colleagues with 100% contract.

Lohnsteuerklasse (Wage Tax Class) of PhD students and Postdocs in Germany

The second factor which largely influences your net salary is “Lohnsteuerklasse” which means the level or grade of your tax in English. Lohnsteuerklasse is indeed the category of salary tax which is a number from “I” to “VI”. The taxing authority assigns you to certain Lohnsteuerklasse based on your circumstances.

A married PhD student or Postdoc will be on Lohnsteuerklasse IV, or V provided that his/her partner is on a paid-working contract. However, if your partner is not working, then you can enjoy Lohnsteuerklasse III. In the very last part of this post, you can see some example calculations of net salary for people with different tax grades to understand the differences.

What is “Stufe” in salary calculation?

Stufe is a German word that means level or grade. In salary calculation, it reflects the experience of the employees. A fresh PhD student will be in Stufe 1, after finishing the first year, you will promote them to Stufe 2. If your PhD takes more than three years, from the start of the fourth year, your Stufe will be 3. The Stufe 4 is for a person with more than 6 years of experience under TVL.

In short, a Postdoc who has lived and worked in German Universities as a PhD student, is generally placed on Stufe 3 at the start. However, Postdocs from abroad (outside of Germany) will be on either Stufe 1 or 2 irrespective of their earlier experiences. If you are an experienced Postdoc, you can discuss that with your employer (HR of the university) before signing your contract. Note that there is a big difference between Stufe 1 and 3. Hence, do not miss this opportunity to get paid better (see the tables at the bottom of the post).

The following video is a MUST-watch if you are planning to do your PhD in Germany. It covers information such as regulations, living expenses, salary and tax, benefits and allowances among others:

Using an online calculator for net salary calculation

Having known the meaning of Lohnsteuerklasse and stufe, you can precisely calculate your net salary. In the following video, you can find step-by-step guidance on how to calculate your take-home money. For doing that, you should visit the following “Offentlicher Dienst website” and enter the numbers based on the discussion above (as stands by September 2020). As the website is in only German, watching the video below can make your job easier!

When you enter your data (watch the video above), click “brechnen” (calculate) at the bottom of the page, and then you can see your net salary details. On the page which appears (look at the following picture as an example), at the very bottom there is a table in which you can find “Grundgehalt” (Basic salary), “Brutto gesamt” (totally gross) as well as “Netto gesamt” (total net). Your monthly net salary would be the number that appears in front of “netto gesamt” in green (highlighted). At the same time, you can see how much would be your salary if you were promoted to Stufe 2, 3 and so on in the next columns of the tables.

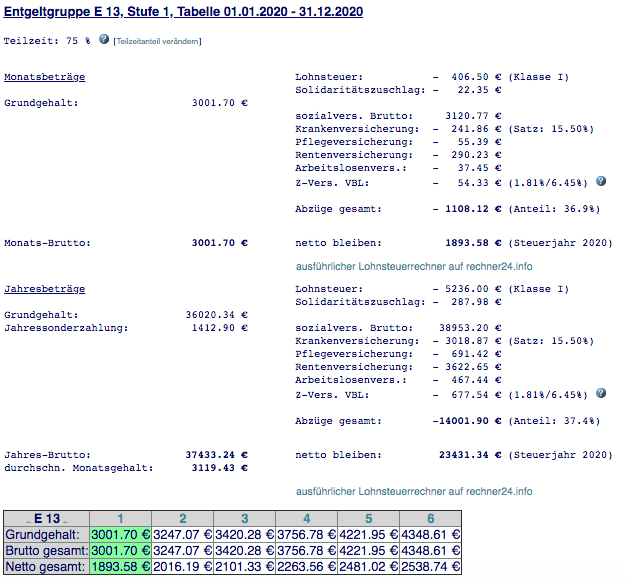

Example: PhD student with contract TV-L E13 (75%)

Let us go through one calculation. For instance, assume you are a PhD student who starts working at a German University. Your contract is 75% (Arbeitszeit) and you are single. So, you have to fill the Arbeitszeit section with 75 and select Lohnsteurklasse I and choose Stufe 1.

After clicking “brechnen” (calculate), the following page appears.

In this particular case, the monthly gross salary is 3001.70 Euro/month while the net salary is 1893.58 Euro/month (both are highlighted in Green at the bottom of the picture. In the second column from the right, the following information is detailed:

Lohnsteure (Income tax) of Klasse I (class I): 406.50 €

Solidaritätszuschlag (Solidarity surcharge): 22.35 €

Sozialvers. Brutto (Natioanl/Social Insurance pre-tax):

Krankenversicherung (Health Insurance): 241.86 €

Pflegeversicherung (Nursing Care Insurance): 55.39 €

Rentenversicherung (Pension Fund): 290.23 €

Arbeitslosenvers. (Unemployment Insurance): 37.45 €

Z-Vers. VBL: 54.33 €

Z-Vers. stands for “Zusatzversorgung des öffentlichen Dienstes” is compulsory insurance. VBLklassik ensures that you receive a company pension in addition to the statutory pension. The rest of the column is exactly a similar calculation for a year!

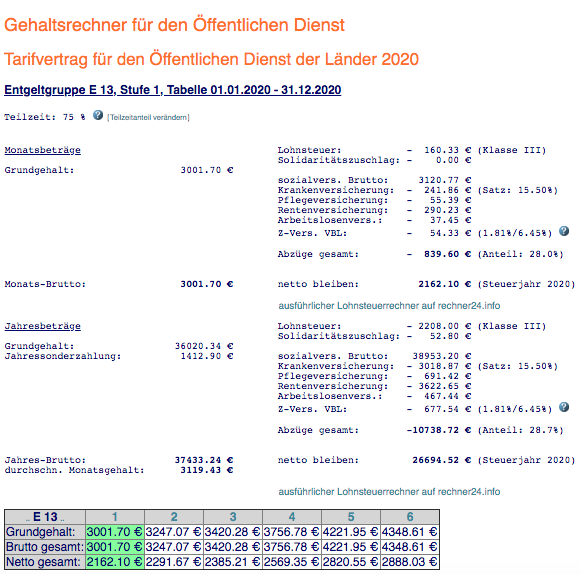

However, if you are married and your partner is not on a paid job, you can change your tax grade (Lohnsteuerklasse) to III. Let’s see how does it affect your net income (take-home money).

As you can see in the picture above, your net income becomes 2162.10 Euro per month which is 268.52 Euro per month more than a person in tax-class I!

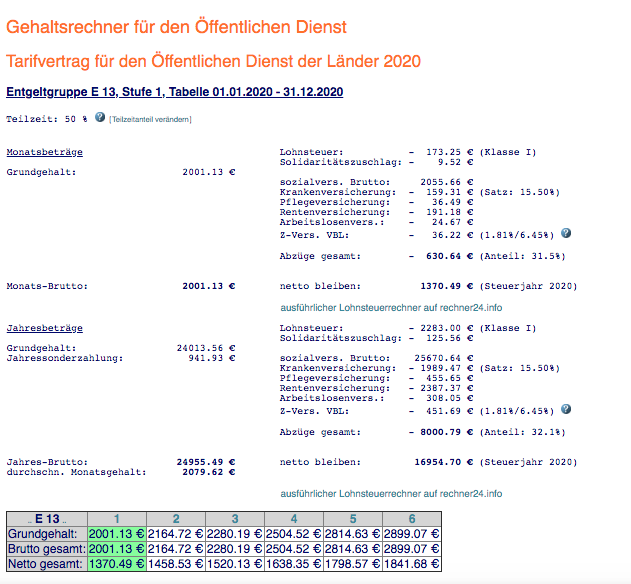

Example: PhD student with contract TV-L E13 (50%)

In this example, we consider a single PhD student (Lohsteuerklasse I) with TV-L E13 (50%). As explained in the previous section, upon entering the corresponding values to the calculator, you will see a page as shown below.

You can see the meaning of the terms in the previous sub-heading. the monthly gross salary is 2001.13 € while the net salary is 1370.49 € (both are highlighted in Green at the bottom of the picture.

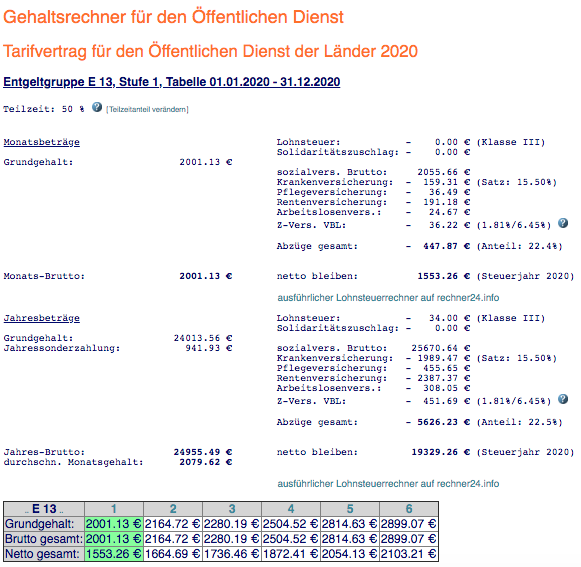

However, a married student whose/her partner is not on a paid job can take home more as shown in the following picture.

As you can see in the picture above, your net income becomes 1553.26 Euro per month which is 182.77 Euro per month more than a person in tax-class I!

Example: PhD student with contract TV-L E13 (100%)

Let’s look at the example of a PhD student with a TV-L E13 (100%) contract. The results are as follows:

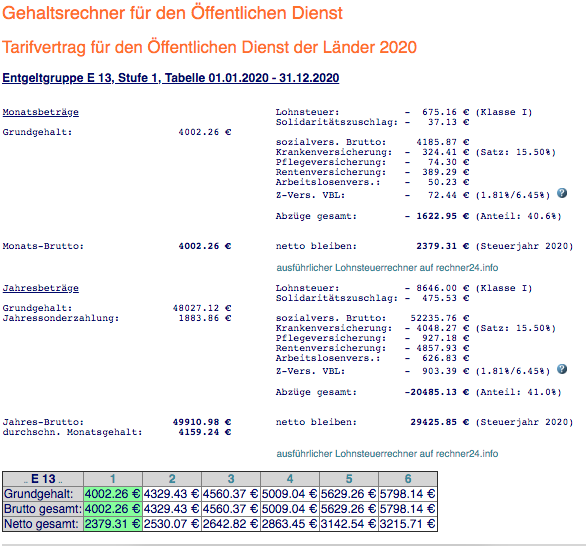

In this case, the gross (before-tax) and net (after-tax) salaries are 4002.26 and 2379.31 Euro per month, respectively.

Again, a married student whose/her partner is not working can take home more by paying less tax (see image below).

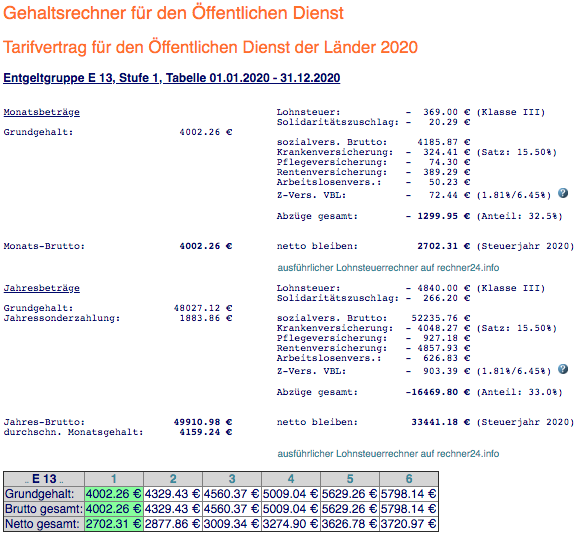

So, for a married employee with TV-L E13 (100%) which is on Lohnsteuerklasse III, the gross (before-tax) and net (after-tax) salary are 4002.26 and 2702.31 Euro per month, respectively. Note that you can see the corresponding salary for the same contract when your “stuff” rises to 2, 3, 4 or 5.

Example: Postdoc with contract TV-L E13 (100%)

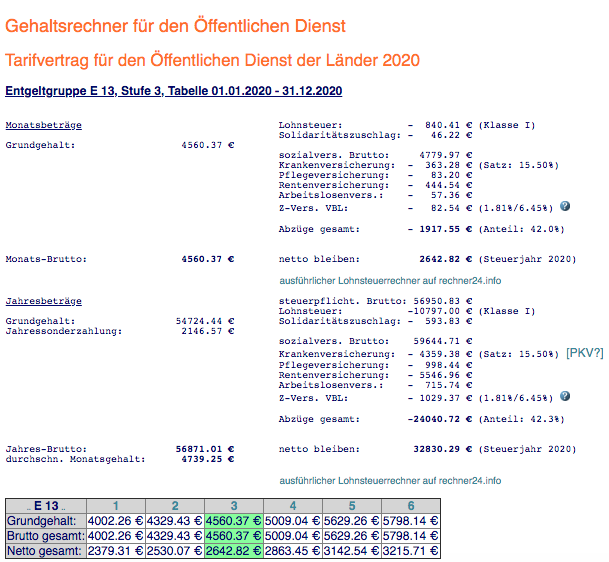

As explained earlier, if your employee put you on “stufe” 1, your net salary is exactly as the one shown above. However, if you are on “Stufe” 2, 3 or 4, your salary becomes much higher. The picture below shows the salary of a Postdoc with TV-L E13 (100%) on Lohnsteuerklasse I.

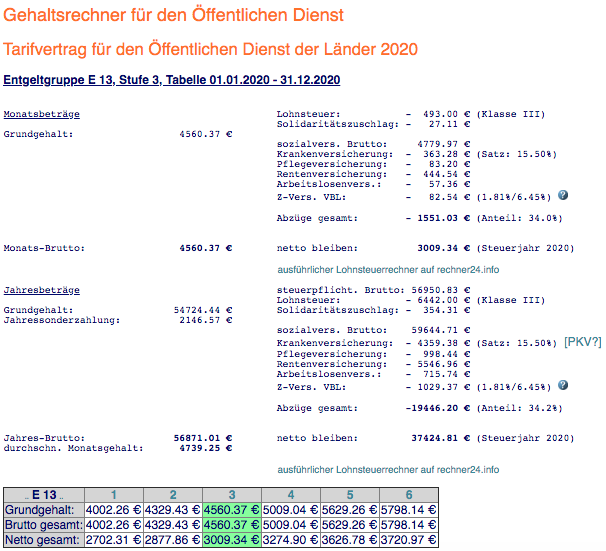

Here, the before-tax monthly salary is 4560.37 Euro whereas the after-tax money is 2642.82 Euro. For the same person but on Lohnsteuerklasse III (married postdoc whose partner is not working), the picture below shows the salary details.

In this case, the monthly net salary (after tax) is 3009.34 Euro. This is almost 358 Euro more than the same postdoc but on Lohnsteuerklasse I.

Hope that will help you to understand all you need to know about PhD students and Postdocs’ salaries in Germany in 2023.

Available Fully Funded PhD and Postdocs in Germany

Below are other German universities with academic positions available (PhD and Postdoc:

- Fully Funded Master, PhD and Postdocs at Max Planck Institutes

- Available Fully Funded PhD and Postdoc Positions at University of Stuttgart

- Fully funded PhD and Postdoc Position at the University of Hamburg

- EU Funding of PhD and Academics in Germany

- Fully Funded Master, PhD and Postdocs at Helmholtz Centers

- Fully funded PhD and Postdoc Positions at the Berlin Institute of Technology

- Fully funded PhD and Postdoc Positions at the Aachen University (RWTH)

- Fully Funded PhD and Postdoc Positions at the Technical University of Munich

- Fully Funded PhD and Postdoc Positions at the University of Cologne

- Fully Funded PhD and Postdoc Positions at University Bremen (univ Bremen)

- Fully funded PhD and Postdocs at Tuebingen University

- Ludwig Maximilian University of Munich (LMU) PhD and Research Vacancie

- Karlsruhe Institute of Technology (KIT) PhD Jobs

- Available Fully Funded PhD and Postdocs at Freiburg University

- Available PhD and Postdoc Vacancies at Free University of Berlin

Interested in discovering the salary figures for PhD and postdoctoral positions in Europe?:

- Salary of PhD student and Postdoc in Denmark

- Salary of a PhD student and Postdoc in Norway

- Salary of PhD student and Postdoc in Switzerland

- Salary of PhD student and Postdoc in Sweden

- Salary of PhD student and Postdoc in Germany

- Salary of PhD and Postdoc in Ireland

- Salary of Postdocs in France

- Salary of PhD student and Postdoc in the UK

- Professors’ salary in the UK

- Salary of PhD student and Postdoc in the Netherlands

- Salary of PhD student and Postdoc in Finland

- Salary of PhD student and Postdoc in Austria

- Salary of Marie-curie postdoctoral fellowship

- Salary of PhD student in Marie-Curie ITN

- Doctorate Degree Business Administration Salary

Fully Funded PhD Positions with Salary

- Germany – Fully Funded PhD

- Switzerland – Fully Funded PhD

- Denmark – Fully Funded PhD

- UK – Fully Funded PhD

- Sweden – Fully Funded PhD

- Finland – Fully Funded PhD

- Netherlands – Fully Funded PhD

- Norway – Fully Funded PhD

- Belgium – Fully Funded PhD

- Austria – Fully Funded PhD

- Australia – Fully Funded PhD

- France – Fully Funded PhD

- New Zealand – Fully Funded PhD

- Canada – Fully Funded PhD

- USA – Fully Funded PhD

- Luxembourg – Fully Funded PhD

- Spain – Fully Funded PhD

- Italy – Fully Funded PhD

- Iceland -Fully Funded PhD

We will update all different types of academic positions, so if you’re looking for a position, think about checking out our Home Page and our Academic Jobs page. You can also follow us on Facebook to be the first to know when we post any new vacancies. But if you are not a fan of reading text, and instead prefer to watch, join our PhD and Postdoc-related videos on our Youtube Channel.